alameda county property tax payment

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check. A message from Henry C.

Understanding California S Property Taxes

The valuation factors calculated by the State Board of Equalization and.

. If we are going to pay by Echeck we select the value we are going to pay with Echeck option then we fill in the terms. Alameda County Property Taxes Payment With E-check. Dear Alameda County Residents.

The median property tax in alameda county california is 3993 per year for a home worth the median value of 590900. You may pay by. 2 beds 1 bath 1216 sq.

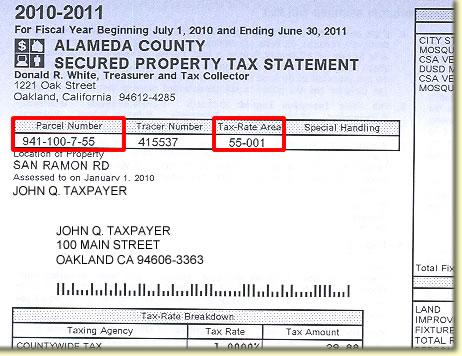

Information on due dates is also available 247 by calling 510-272-6800. You can lookup your assessed value property taxes and. The TTC accepts payments online by mail or over the telephone.

Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us Pay Your Property. A message from Henry C. The valuation factors calculated by the State Board of Equalization and.

443 Haight Ave Alameda CA 94501 699000 MLS 41010799 Buxom beach bungalow in the heart of Alamedas sought-after. Public property records provide information on. Many vessel owners will see an increase in their 2022 property tax valuations.

Many vessel owners will see an increase in their 2022 property tax valuations. The due date for property tax payments is found on the coupons attached to the bottom of the bill. You can place your check payment in the drop box located at the lobby of the County Administration building.

Dear Alameda County Residents. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System.

Alameda County Ca Property Tax Search And Records Propertyshark

Piedmont Property Taxes Due Nov 1 In Alameda County Piedmont Ca Patch

County Of Alameda Ca Government This Is A Reminder That The 2021 2022 Unsecured Property Tax Is Due On Tuesday August 31 2021 If Not Paid By This Date The Tax

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

A Message From Alameda County Treasurer Tax Collector Penalty Waivers Youtube

Alameda County Property Tax Tax Collector And Assessor In Alameda

Alameda County Property Tax Tax Collector And Assessor In Alameda

Michael Barnes Albany City Council Meeting Comments And More Page 2

Rebecca Sayami Realtor Some Counties Have Deferred Property Tax While Others Are Still Collecting On April 10th If You Are In Alameda County Don T Forget They Still Want You To Pay

Search Unsecured Property Taxes

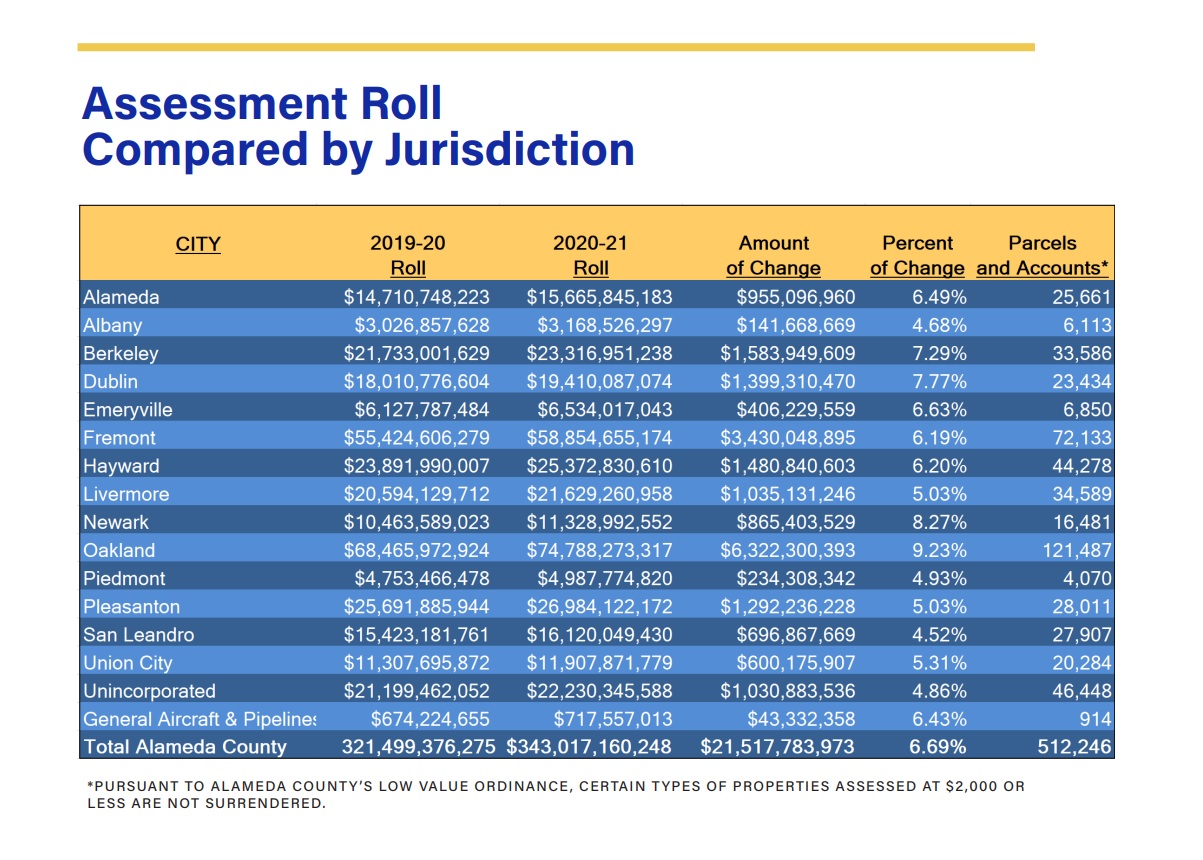

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Alamedacounty Twitter

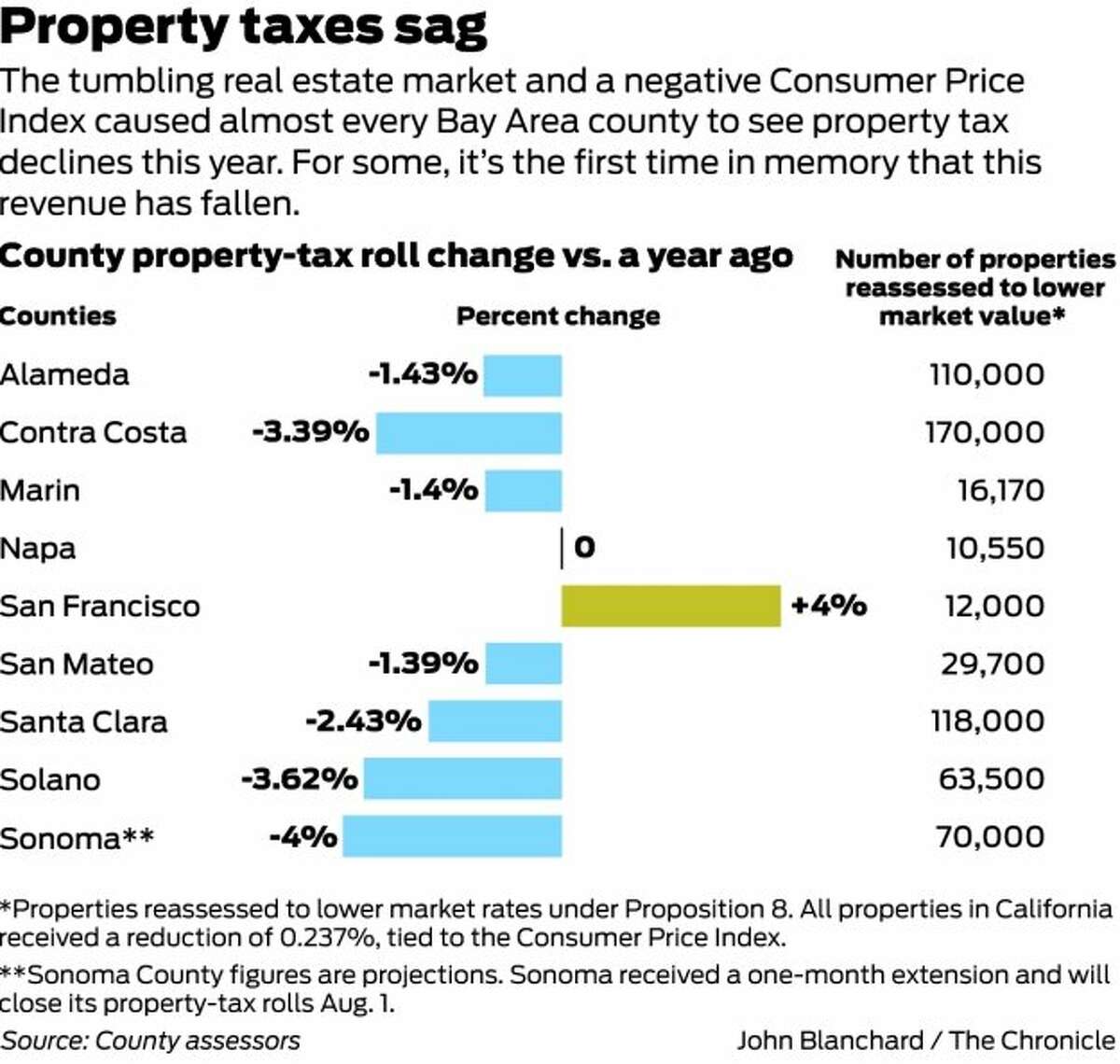

Record Declines In Bay Area Property Taxes

Faqs Assessor Recorder County Clerk County Of Marin

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates